The Company’s volumes and risk factors are presented in accordance with the updated and revised June 2018 SPE/WPC/AAPG/SPEE/SEG/SPWLA/EAGE Petroleum Resource Management System (“PRMS”).

Contingent Resources are those quantities of petroleum estimated, at a given date, that are potentially recoverable from known subsurface accumulations, but the applied project(s) are not yet considered mature enough for commercial development due to one or more contingencies.

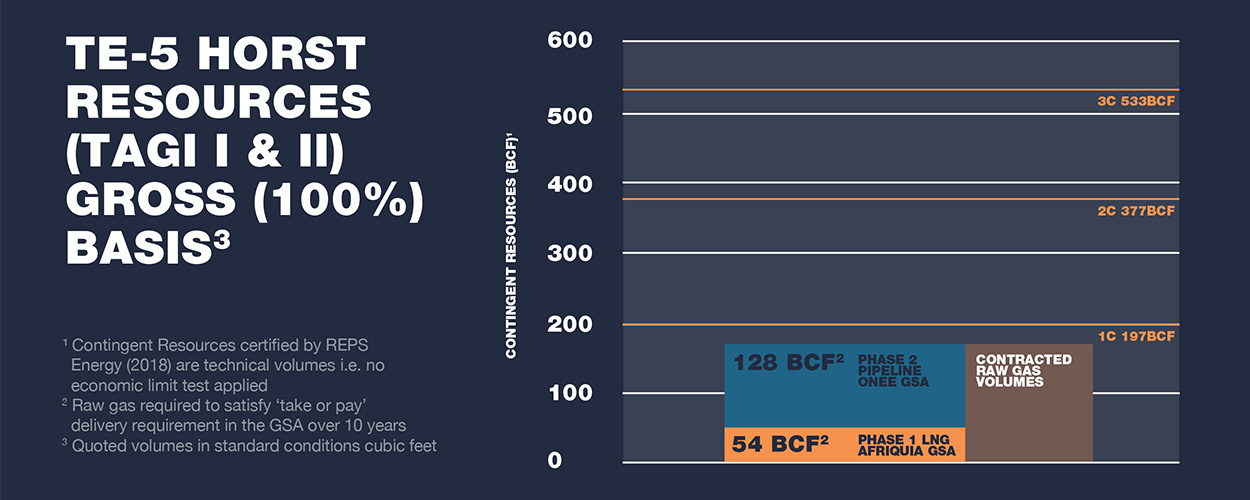

The Tendrara Production concession contains Contingent Resources. In late 2017, Sound Energy undertook a resource evaluation exercise for the Tendrara discovery. This exercise was conducted by a leading independent technical consultancy, RPS Energy Consultants Ltd ("RPS”). The results of the resource evaluation were presented in a Competent Persons Report (“CPR”). The table below summarises the Discovered Gas Originally in Place and the Contingent Resources1 for the Tendrara TE-5 Horst within the Concession certified by RPS, as announced by the Company on 20 December 2017 and 23 January 2018 and the net interest to the Company2.

|

Segment name |

Discovered Gas Originally In Place (Bcf) |

Contingent Resources (Bcf)¹ |

Contingent Resources (Bcf)¹ |

||||||

|

Gross (100%) basis |

Gross (100%) basis |

Net to Company (75%) basis |

|||||||

|

Low |

Mid |

High |

1C |

2C |

3C |

1C |

2C |

3C |

|

|

TE-5 Horst |

349 |

651 |

873 |

197 |

377 |

533 |

148 |

283 |

400 |

Summary table showing the range of Discovered Gas Originally In place and Contingent Resources, gross, for the TE-5 Horst accumulation (TAGI Reservoir), within the Tendrara Production concession.

At the point of Final Investment Decision (“FID”) for each phase of the Tendrara TE-5 Horst development project, it is expected that a portion of these Contingent Resources will be converted into Reserves. Projects that are classified as Reserves will meet the following criteria:

1 Contingent Resources are technical volumes i.e. no economic limit test applied

2 Under the principal terms of a Profit Sharing Deed, the Company, together with its subsidiaries, will pay to Schlumberger Holdings II Limited an amount equivalent to between 8% and 11% of total net profits (after costs, taxes and other applicable deductions) arising from the Concession over a period of 12 years from first commercial production from the Concession.